As global demand for crude oil soars, Texas confronts a new challenge, emphasizing the need for strategic investments in its pivotal role in meeting global energy needs.

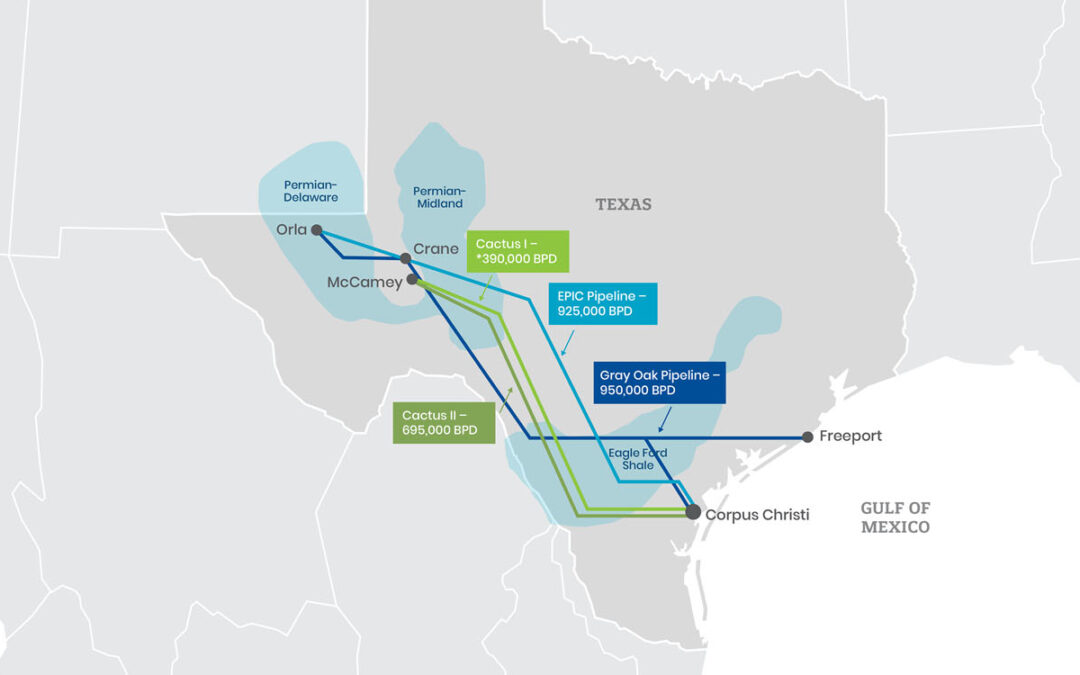

As global demand for crude oil surges, Texas faces a significant challenge: crude oil pipelines are running out of room. Key pipelines connecting the prolific Permian Basin to the Port of Corpus Christi, a critical export hub, are nearing capacity. This congestion threatens to limit U.S. oil exports at a time when the world needs American crude oil more than ever.

Crude oil pipelines from the Permian Basin to Corpus Christi are operating at over 90% capacity, and projections suggest that by the end of 2025, they could reach up to 95% use. With the U.S. set to hit new oil production records next year, this bottleneck could stem the flow of incremental output to international markets, tightening the global supply even more.

TXOGA Chief Economist Dean Foreman emphasized the gravity of the situation recently by saying, “The Permian Basin is a cornerstone of U.S. oil production, and its output is critical to global energy markets. The current pipeline constraints not only threaten to create domestic oversupply but also impact our ability to support allies and trading partners who rely on American oil.”

The Permian Basin, accounting for nearly half of all U.S. oil production, is a powerhouse. However, without sufficient pipeline capacity, the region’s production growth cannot fully translate into increased exports. This issue is particularly pressing given the global reliance on American oil, especially following geopolitical disruptions like Russia’s invasion of Ukraine.

Foreman noted that the pipeline bottleneck is not only an economic issue but also a strategic one. “Ensuring that our pipeline infrastructure can handle increased volumes is vital for maintaining our position as a leading energy exporter and supporting global energy security,” Foreman said earlier this month.

The Waha Hub, crucial for the Permian Basin’s natural gas industry, exemplifies the broader challenges faced by the Texas oil and natural gas sector. The hub is an essential point in a vast network of pipelines connecting production to domestic and international markets. However, it also faces issues like negative natural gas prices due to seasonal demand fluctuations and pipeline capacity limits.

“West Texas needs robust pipeline infrastructure to move natural gas, a by-product of oil production, to consumer markets or export points. Seasonal drops in in-region demand have led to excess supply and negative spot prices at the Waha Hub. This underlines the need for strategic investments in pipeline capacity to stabilize the market and support continuous growth,” TXOGA’s Foreman said about the situation.

The Texas Pipeline Association echoed this sentiment. TPA President Thure Cannon stated, “As production and supply continue to grow, developing new market access pipelines is crucial. Limited local demand and pipeline takeaway capacity have depressed regional prices, particularly in shoulder months. Addressing these bottlenecks is essential for the midstream industry to keep delivering vital hydrocarbons.”

The Texas oil and natural gas industry faces complex challenges tied to global market dynamics and infrastructure constraints. Despite these hurdles, the industry remains committed to maintaining its vital role in the global energy landscape.

Foreman concludes, “Our members’ efforts in navigating these complexities and ensuring the steady production of oil and natural gas are commendable. Strategic infrastructure investments are key to sustaining this momentum and meeting global energy needs effectively.”

Texas’ oil and natural gas sector stands at a crossroads. With crude oil pipelines nearing capacity and global demand escalating, the industry looks to prioritize infrastructure development to maintain its crucial role in the energy market. By addressing these challenges head-on, Texas can continue to be a reliable source of energy for the world.