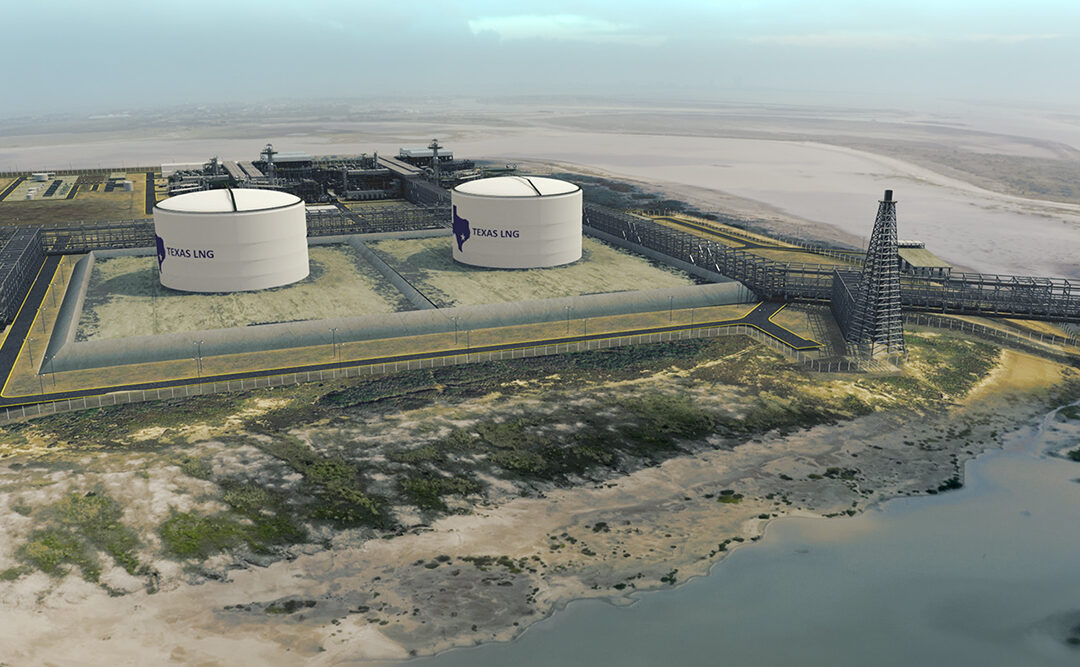

Source: Texas LNG

With global demand soaring and Europe leading the charge, U.S. LNG exports hit all-time highs, fueled in large part by Texas’ unprecedented natural gas production.

U.S. liquefied natural gas (LNG) exports have reached unprecedented levels in 2025, reinforcing the nation’s position as the world’s leading supplier of the super-cooled fuel. From January through August, LNG exports rose by 22% compared to the same period in 2024, totaling 69 million metric tons (14.3 billion cubic feet per day, bcf/d), according to estimates from the Energy Information Administration. This sharp increase in export volumes reflects expanded capacity and increased global demand, particularly from Europe, underscoring the vital role natural gas plays in energy security. Behind much of this growth is the expansion of production from states like Texas, which set a new high for natural gas marketed production earlier this year in March 2025, reaching 34.4 billion cubic feet per day.

Europe has emerged as the dominant consumer of U.S. LNG, accounting for about three-quarters of exports through the first five months of 2025. This marks a significant shift in global trade flows, with U.S. LNG exports displacing Russian natural gas supplies amid geopolitical and economic realignment. Notably, European LNG imported volumes from the U.S. rose 42.6% over the first five months of 2025 compared to the same period last year. Texas, with its proximity to Gulf Coast export terminals and strong infrastructure, has been central to meeting this demand. In February alone, the state exported 8.9 bcf/d as LNG, per the U.S. International Trade Commission’s reporting on Texas export zones, 74.2% of which served European markets.

Texas’ natural gas demand has also reached a record high, averaging over 14 bcf/d through the first five months of 2025. Industrial consumers–the single largest segment–increased their consumption by 3.3% over the same period versus last year. The next largest segment, natural gas consumption for power generation, also rose 0.9% y/y over the period.

Demand from the LNG export sector has become the fastest-growing segment in the U.S. and Texas natural gas markets. Since 2019 compared with the first five months of 2025, LNG exports by the U.S. and Texas have increased by over 180% and 450%, respectively.

Much of this growth has been supported by Texas producers, who continue to deliver strong volumes to export terminals along the Gulf Coast. Texas’ total natural gas reached as high as 14.2 bcf/d in February, including pipeline exports to Mexico, reinforcing the state’s critical role in both North American and global energy systems.

The rise in global LNG demand, driven by European shortfalls and shifting trade relationships, has shown no signs of slowing. Despite Asia Pacific scaling back imports due in part to China’s policy shifts, the U.S. — and by extension Texas — has continued to step up to supply global natural gas markets. The resulting increase in U.S. share of global LNG exports, estimated at 24.5% by Reuters, reflects this realignment and highlights the importance of a resilient, well-supplied production base.

As LNG becomes a defining force in global energy dynamics, the ability of U.S. producers to meet demand is key. Texas continues to lead on that front, with record-setting output and strong infrastructure positioning the state as the cornerstone of U.S. natural gas exports. The trends in 2025 reflect a broader shift in which domestic energy policy, global geopolitics, and the capacity to deliver are tightly interlinked, making Texas natural gas not just a regional asset, but a global one.